Corporate Transparency: Federal and Ontario Requirements for Individuals with Significant Control

June 19, 2025

Here’s the information about your corporation that needs to be collected, filed and disclosed to the public.

In recent years, in seeking to align with global standards aimed at combating money laundering and tax evasion, Canada has taken significant steps toward enhancing corporate transparency, particularly concerning the identification of individuals with significant control (ISCs) over domestic corporations.

Both the Canada Business Corporations Act (CBCA) governing federal corporations and the Business Corporations Act (Ontario) (OBCA) governing Ontario corporations now mandate that private corporations maintain detailed records of their ISCs. However, there are some significant differences between the CBCA and the OBCA with respect to the kinds of information that are required to be maintained on ISCs and the extent to which such information is publicly disclosed.

As discussed in more detail below, public companies and their wholly owned subsidiaries are generally exempt from ISC requirements.

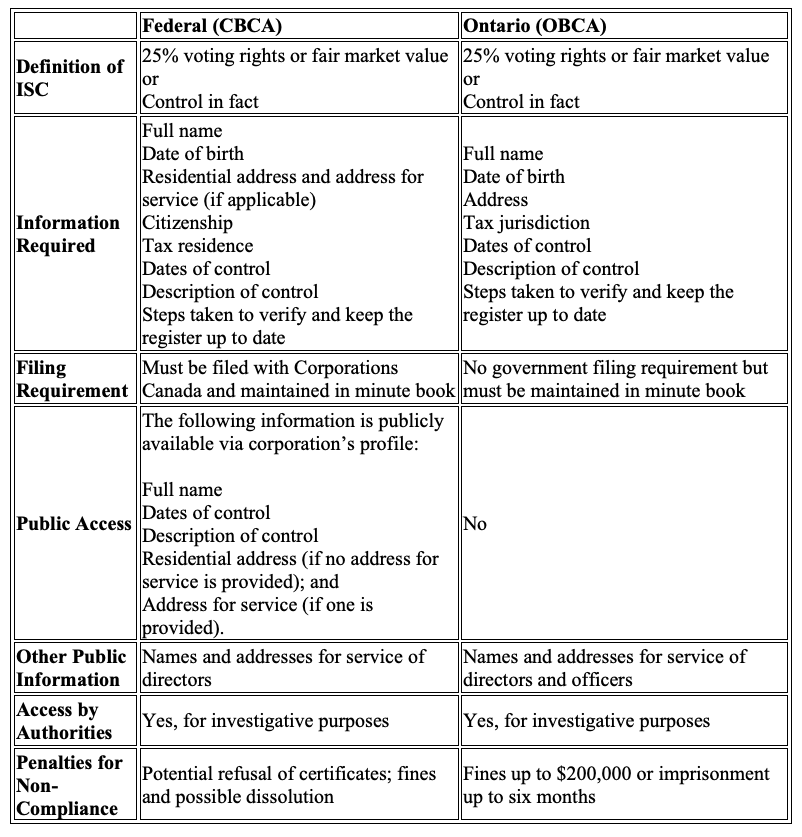

Here is a table of the key similarities and differences between the CBCA and the OBCA (more detailed discussion can be found below):

Contents:

Federal Requirements: Canada Business Corporations Act (CBCA)

Key Provisions:

- Definition of ISC: An individual is considered to have significant control over a corporation if he or she:

- holds 25% or more of the voting rights attached to all of the corporation’s outstanding voting shares;

- holds 25% or more of all of the corporation’s outstanding shares measured by fair market value;

- has direct or indirect influence that, if exercised, would result in control in fact of the corporation; or

- is subject to prescribed circumstances under the regulations.

- Information to be Maintained: Each federal corporation is required to maintain in its minute book an accurate and up-to-date ISC register containing the following information for each ISC:

- full legal name;

- date of birth;

- citizenship;

- residential address;

- address for service;

- tax residence;

- date when the individual became or ceased to be an ISC;

- description of how the individual qualifies as an ISC; and

- description of steps taken to verify information.

- Filing Requirements: Beginning January 22, 2024, each federal corporation must file its ISC information with Corporations Canada on each of the following occasions:

- upon incorporation;

- with each annual return;

- within 15 days of any change to the ISC information; and

- after amalgamation or continuance to a federal jurisdiction.

- Compliance and Penalties: Non-compliance with these obligations can result in significant penalties such as fines up to $100,000. Directors and officers who knowingly permit or acquiesce in the contravention of these requirements, or who provide false or misleading information, may face fines up to $1 million and/or imprisonment for up to five years. Shareholders who knowingly fail to provide required ISC information may also face similar penalties. Additionally, Corporations Canada has the authority to administratively dissolve non-compliant corporations or refuse to issue a certificate of existence or compliance.

What Gets Made Public

The following ISC information filed with Corporations Canada is made publicly available on the corporation’s public profile:

- the individual’s full legal name;

- the date the individual became an ISC and ceased to be an ISC, as applicable;

- the description of the ISC’s significant control;

- the residential address (will be made public if no address for service is provided); and

- the address for service (if one is provided).

However, certain exceptions apply, such as for individuals under 18 years of age or those to whom prescribed circumstances apply.

Consistent with standard practice, the names and addresses for service of directors of a CBCA corporation are part of the public record.

Ontario Requirements: Business Corporations Act (Ontario) (OBCA)

Key Provisions:

- Definition of ISC: An individual is considered to have significant control over a corporation if they meet any of the following criteria:

- hold 25% or more of the voting rights attached to all of the corporation’s outstanding voting shares;

- hold 25% or more of all of the corporation’s outstanding shares measured by fair market value;

- have direct or indirect influence that, if exercised, would result in control in fact of the corporation; or

- are subject to prescribed circumstances under the regulations.

- Information to be Maintained: Corporations are required to maintain a register containing the following information for each ISC:

- full legal name;

- date of birth;

- latest known address;

- jurisdiction for tax purposes;

- date when the individual became or ceased to be an ISC;

- description of how the individual qualifies as an ISC; and

- a description of the steps taken to verify information.

- Compliance and Penalties: Corporations are obligated to take reasonable steps to ensure the accuracy and completeness of their ISC register. Penalties for non-compliance can include fines of up to $200,000 or imprisonment for up to six months for directors, officers, or shareholders who knowingly contravene the requirements.

What Gets Made Public

Unlike with federal corporations, no information from the ISC register of an OBCA corporation is publicly accessible. Access is limited to specific authorities, including law enforcement, tax authorities, and certain regulatory bodies, for investigative and enforcement purposes.

As always, the names and addresses for service of an OBCA corporation’s directors and officers, along with the dates they assumed their roles, are publicly available.

Who Is Exempt from Creating and Maintaining an ISC Register?

Some federal and Ontario corporations are not required to comply with this obligation because their ISC information is already accessible elsewhere (e.g., under securities laws), or because they are fully owned by the Canadian government. The following types of corporations are exempt:

- reporting issuers under provincial securities laws, or corporations wholly owned by such issuers;

- public corporations listed on a stock exchange recognized under the Income Tax Act, or their wholly owned subsidiaries; and

- crown corporations, as well as their wholly owned subsidiaries.

Transparency Requirements in Other Provinces

Many other Canadian provinces have also adopted measures to enhance corporate transparency by requiring private corporations to maintain records ISCs.

British Columbia is developing a public beneficial ownership registry, expected to be operational in the fall of 2025, making certain ISC information accessible to the public.

Quebec has taken a similar approach through its Enterprise Register (Registraire des entreprises), which already includes public disclosure of some beneficial ownership information for businesses registered in the province.

In Alberta, in addition to maintaining an ISC register, corporations must also keep separate internal records of their top five voting shareholders, including each shareholder’s name, address, and percentage of issued voting shares held. This shareholder information is collected as part of the annual return filing process, and becomes publicly available through each corporation’s profile.

Key Take-aways

- Corporations must identify and maintain records of ISCs who beneficially own at least 25% of the votes or value of the company, or who otherwise exercise effective control over the company. Non-compliance can result in significant penalties for companies and their directors, officers, and shareholders.

- Federal corporations must file ISC information with Corporations Canada, and some of it becomes publicly accessible.

- Ontario corporations must keep ISC records internally but are not required to file or make them public.

- Several other Canadian provinces, including British Columbia, Alberta, and Quebec, require the public disclosure of shareholders or beneficial owners or are taking steps to require such disclosure in the near future.

- As transparency pressures mount both domestically and internationally, more provinces may move toward public registries to align with global standards aimed at combating money laundering and tax evasion.

Our Corporate Services

We are dedicated to providing premium corporate and entity management services to our clients. We work with companies of all sizes and at all stages of their life cycle assisting with incorporations, business name registrations, maintenance of the minute books and more.

We also assist with the preparation, maintenance and filing (if applicable) of information relating to individuals with significant control for OBCA and CBCA corporations.

We keep and maintain minute books and records for over 1,000 corporations and partnerships. All records are fully scanned and made available to our clients through our online portal.

Feel free to contact our team and we would be delighted to assist.

This blog post is not legal or financial advice. It is a blog which is made available by SkyLaw for informational purposes and should not be used as a substitute for professional advice from a lawyer.

This blog is subject to copyright and may not be reproduced without our permission. If you have any questions or would like further information, please contact us. We would be delighted to speak with you.

© SkyLaw . All rights reserved. SkyLaw is a registered trademark of SkyLaw Professional Corporation.